How To Choose Between In-App Purchases And External Payment Gateways?

In-app purchases

Apps in all categories on the App Store for iPhone and iPad users and Google Play for Android users have in-app purchases, the prompt users to consume money on the game ads, subscriptions, premium features, and more. These extra optional costs can go straight on credit cards without any alert to the money holder of people.

Categories of in-app purchase

Consumable purchases

These are mostly used in mobile games where users pay money to gain access to special features, advantages, and in-game currency.

Non-consumable purchase

One-time payments that are made to gain access to permanent that are special features.

Renewable subscriptions

This is the model used by streaming services like Netflix and Hulu. This gives the user access to streaming content and updates while renewing the subscription automatically otherwise the user decides to terminate it.

Non-renewable subscriptions

This offers users limited access to special advantages and is manually renewed by the user with money.

Benefits

Access to the freemium model

Users can try out the app with its basic features for free to access but have to pay access to more premium and special features and upgrade to a better pro version. Developers can make use of targeted ads, offers in-app messages, and push notifications to keep consumers engaged.

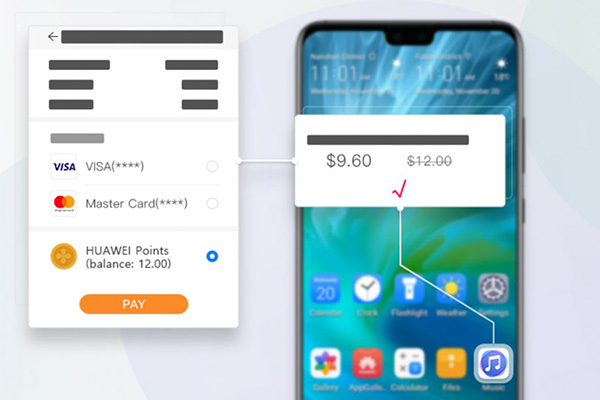

Ease of payments

Making in-app purchases do not require users to fill out long-form requirements and can easily make payments with a few taps and biometric steps.

Payment gateway

Based on authorized payment a gateway act as a portal to facilitate transaction flow between clients and merchants. It makes use of safety protocols and encryption by skipping the transaction data safely. The data is transferred from websites/applications/mobile devices to payment processors/banks. Generally, there are four main methods to integrate a payment gateway:

Hosted gateway

A hosted payment gateway acts as a 3rd party because it calls for your clients to leave your website to buy. it’s far used for small or local organizations that are greater comfortable with the use of an outside payment processor.

Direct post method

It is an integrated approach that permits a client to keep without leaving your website, as you don’t should acquire the PCI compliance. it assumes that the transaction’s detail is posted after a client clicks a button. The data instantly get to the gateway and processor without being saved to your personal server.

Non-hosted (integrated) method

A mixed payment gateway permits you to keep the customer at your website during the purchase. Non-hosted payment gateway providers permit for integrating through APIs.

Benefits

• A hosted payment gateway is all payment facilities taken by the service provider. Client card details are also stored by the manufacturer. So, this payment gateway requires no PCI compliance and offers easy integration.

• A direct post method is equal to a non-hosted payment gateway. You get the customization options and branding options and the clients perform all the necessary actions on a single page.

• The benefit of non-hosted methods is full control over the transactions at your website to customize your payment system according to your permission for your business needs.

Popular payment gateway providers

PayPal payment gateway

PayPal is possibly the most used payment gateway solution, so let’s start with it. The company provides mobile payment services for customers from over two hundred countries and accepts twenty-five different currencies. It is a free payment that provides an aggregate to sell your products. This system is evolving all over time and comes with plenty of features you can make use of in your application.

Stripe payment

This gateway solution provides authorization, mobile and desktop applications for the checkout process, analytics, and many useful options. The awesome feature is Stripe.js, the company’s secure transmission for the web.

Amazon payments

Amazon Payments is an eCommerce platform designed for online retailers. Amazon Pay is an integrated API that provides a semi-integrated payment solution. It’s available for all mobile devices to use. Amazon service supports all the major payment methods and credit cards.

Authorize.net

Authorize.net is making for small- and medium level businesses. Their service also provides all the payment method support, and moreover, PayPal payments, Apple Pay. And also protects users’ information from illegal transactions from advanced Fraud Detection. They also support integrated mobile applications.

Conclusion

Understanding when need to use IAP is important – while it’s convenient and secure, it does have its drawbacks as both Google and Apple collect a 30 percent fee for anything sold using this method when business revenue is over a million and 15percent for those making less. And in case you are looking for a way to enhance consumer confidence, combine a payment solution that will encourage trust, assist a couple of payment strategies, and be protected from fraudulent actions.

Leave A Comment

You must be logged in to post a comment.